Silver Rise 2025: Why the Metal Spiked — Is Now the Golden (or Silvery) Chance to Buy?

Silver Prices Rise in 2025

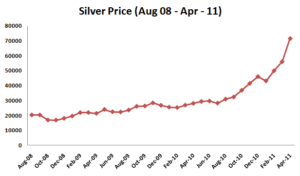

The price of silver has seen a sharp and unexpected climb in 2025, surprising both small investors and large bullion traders across India. After several years of moderate movements, silver has surged from around ₹55,000–₹75,000 per kilogram (2020–2024 average) to an astonishing ₹1,27,000 per kilogram in late 2025 — almost doubling in value within a year.

This jump has placed silver back in the spotlight, not just as a traditional metal for ornaments but also as a strategic investment asset.

| Year | Average Price (₹/kg) | Trend Summary |

|---|---|---|

| 2020 | ₹54,700 | Pandemic volatility, flight to safe assets |

| 2021 | ₹66,900 | Post-stimulus gains and renewed optimism |

| 2022 | ₹57,700 | Global economic correction and pullback |

| 2023 | ₹62,800 | Stable year with limited upside |

| 2024 | ₹74,900 | Industrial demand revived |

| 2025 | ₹1,27,300 | Sharp spike — record levels in India |

Why the Sudden Rise?

There’s no single reason behind the surge — it’s the perfect storm of global and local factors:

Geopolitical Uncertainty: Global conflicts and inflation fears pushed investors toward safe-haven metals like silver and gold.

Weak Rupee and Global Rates: The Indian rupee’s depreciation made imported bullion costlier, automatically boosting domestic silver prices.

Industrial Boom: Silver is heavily used in solar panels, electric vehicles, and electronics — and India’s green energy transition is fuelling demand.

Reduced Supply: Global silver mining faced production constraints, while physical demand in India remained high for jewelry and utensils.

The combination of these elements has led to a strong rally across Indian exchanges and bullion markets.

Is It Safe to Invest in Silver Now?

Safety depends on your investment approach. Silver is a proven hedge against inflation and currency weakness, but it also carries higher volatility than gold. Here’s what to keep in mind:

Diversify, Don’t Overcommit: Silver should form part of a diversified portfolio (10–20%) rather than a sole investment.

Expect Short-Term Swings: The same factors that cause quick gains can lead to sudden corrections.

Think Long-Term: Industrial and renewable energy demand may keep silver prices elevated for the next decade.

Consider Different Forms: You can invest through silver bars, coins, ETFs, or digital silver — each with different liquidity and storage options.

Overall, silver remains a relatively safe medium- to long-term bet, especially for those seeking tangible, inflation-protected assets.

Is This a Golden Chance to Invest?

Absolutely — for the right investor.

The 2025 rally is more than a short-term bubble; it’s backed by fundamentals like renewable energy expansion, industrial consumption, and macroeconomic uncertainty. However, timing matters.

Buy in Phases: Instead of putting all your money at once, consider systematic purchases (SIP-style).

Monitor Global Cues: Watch for changes in US interest rates, rupee movement, and gold trends.

Don’t Panic During Dips: Corrections are natural in volatile assets; long-term trends remain positive.

If you missed gold’s 2020 rally, this could be your “silver moment” to accumulate before prices stabilize at higher levels.

Quick 5-Year Comparison (₹ per kg)

2020: ≈ ₹54,700 per kg (pandemic volatility)

2021: ≈ ₹66,900 per kg (post-stimulus gains)

2022: ≈ ₹57,700 per kg (minor pullback)

2023: ≈ ₹62,800 per kg (steady year)

2024: ≈ ₹74,900 per kg (renewed upward pressure)

2025 (present spot): ≈ ₹1,27,300 per kg (sharp spike, near record highs)

Final Thoughts

The sudden rise of silver in India and globally signals both opportunity and caution. For investors looking beyond equities and crypto, silver offers a tangible hedge and strong industrial future.

Whether you buy physical silver, ETFs, or trade digitally, this may indeed be the “golden chance” to invest in silver — but make sure your strategy is informed, disciplined, and long-term focused