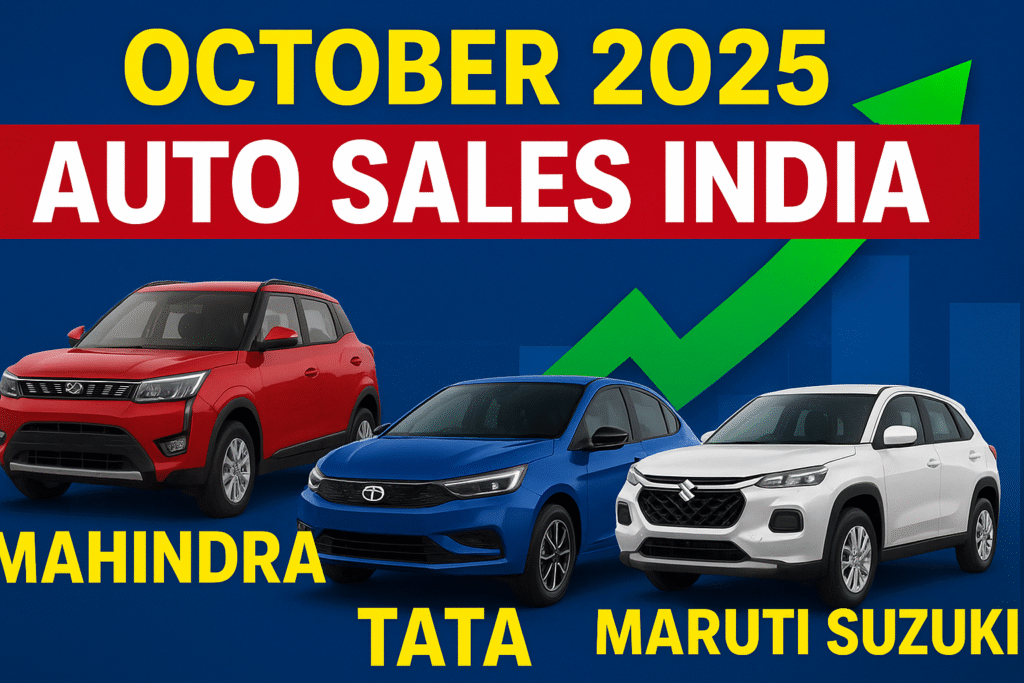

India’s Car Market on Fire: Mahindra, Tata & Maruti Suzuki Record Big Gains in October 2025

Mahindra, Tata & Maruti Suzuki Lead India’s October 2025 Car Sales Growth

As India heads into the heart of the festive season, October 2025 is shaping up to be a pivotal month for automakers. The combination of tax reforms, pent-up demand, and strategic discounting has fueled a sharp uptick in vehicle sales. Among leading players, Mahindra, Tata Motors, and Maruti Suzuki are already registering strong gains, each riding different strengths in this rebound. In this article, we analyze the rising sales trends, breaks down the underlying drivers, and forecast whether this momentum can be sustained.

Industry Backdrop: Why October 2025 Matters

The Government of India recently revised the Goods and Services Tax (GST) structure, particularly easing tax burdens on SUVs and larger displacement vehicles.

The festive season (Navratri, Diwali) historically triggers a spike in consumer purchases, especially in automobiles.

Dealers across the country report increased footfalls and booking inquiries following visible price reductions and promotional offers.

These confluences set the stage for a possible strong rebound in October 2025, especially for SUV makers and brands with a broad portfolio.

Mahindra: Strength in SUVs & Recovery Mode

Recent Performance

In September 2025, Mahindra’s overall auto sales rose ~16% to 1,00,298 units (including exports) compared to the same period last year.

The company also noted a 10% year-on-year bump in SUV sales to dealers in the same month, rebounding from a declined August.

During the first nine days of Navratri, Mahindra’s SUV sales surged over 60% YoY, highlighting the pull of festive demand.

October 2025 Outlook

Given the tax cuts benefiting larger vehicles (especially SUVs above 1,500 cc), Mahindra is well positioned to capitalize. The brand’s entire product range is heavily skewed toward SUVs and utility vehicles — enabling it to benefit disproportionately from the GST revision.

If festive demand holds and supply constraints don’t emerge, Mahindra could achieve one of its strongest October performances in recent years.

Tata Motors: Record Sales Ride Tax Cuts & Portfolio Depth

September 2025 as a Prelude

Tata Motors hit a record monthly sales in September 2025, delivering 60,907 passenger vehicles (up ~47% YoY) thanks to GST cuts and festive incentives.

Its retail PV registrations (including EVs) reached 40,594 units in September, overtaking Mahindra and Hyundai in rank.

Tata also reported a surge in EV sales (9,191 units, ~96% YoY) and its highest ever CNG vehicle sales (~17,800 units).

Why October 2025 Could Be Bigger

Tata’s advantage lies in its diversified powertrain portfolio: ICE, EV, and CNG. The GST cuts, combined with competitive discounts on ICE models, remove some pricing barriers.

Moreover, Tata’s strong brand push on models like the Nexon (which saw over 22,500 sales in September) could carry momentum into October.

If Tata maintains inventory discipline and marketing push, it might challenge Maruti more aggressively in the coming months.

Maruti Suzuki: Resilient Base + Policy Tailwinds

While Maruti Suzuki has historically dominated India’s passenger car market, the recent shifts present both challenges and opportunities.

Market Position & Policy Benefit

Maruti remains the largest carmaker by volume in India, with robust brand recall and deep dealer reach.

Proposed relaxations in fuel efficiency norms for small cars could benefit Maruti’s compact models (e.g., Alto, Wagon R), reducing the cost burden on compliance.

Challenges & Opportunity

The tax reforms have arguably favored SUV/large displacement segments more, which benefit Mahindra and Tata’s newer offerings.

Maruti may need to lean more into its mid-sized SUVs (like the Brezza, Grand Vitara) or crossovers to maintain growth.

If Maruti can selectively increase discounts on smaller models and highlight fuel efficiency, it can still capitalize on the festival market surge.

| Metric / Aspect | Mahindra | Tata Motors | Maruti Suzuki |

|---|---|---|---|

| Strengths for October 2025 | SUV-heavy portfolio, direct benefit from tax cuts | Diverse powertrain (ICE, EV, CNG), recent record sales | Deep distribution, small car dominance |

| Risks / Constraints | Dependence on SUV demand, supply or chip constraints | Overleveraging discounts, margin pressures | Less advantage from tax cuts, need to push transitions to SUVs |

| Momentum drivers | Festive demand, SUV tax cuts, dealer push | EV + CNG surge + ICE discounting | Norm relaxations, competitive pricing, branding efforts |

Conclusion & Outlook

October 2025 is shaping up to be a turning point in India’s passenger vehicle market. Mahindra is likely to benefit the most because of its SUV-skewed lineup and direct gains from GST cuts. Tata Motors, riding high on its record-setting September, has a real shot at sustaining momentum across ICE, EV, and CNG segments. Maruti Suzuki, while still dominant in volume, must adapt quickly by promoting its SUVs and leveraging fuel-efficiency advantages.

If demand holds through the festive season and supply chains stay intact, October could deliver one of the strongest auto sales months in recent memory.